The Skinny

The Financial Services industry is going through a mesmerizing transformation due to innovations that use a combination of data analytics, AI, blockchain and intuitive user interfaces.

These innovations have simplified banking and insurance processes, allowed access to credit and banking for previously underserved communities and brought modern experiences to banking to suit a millennial lifestyle.

A large telco has three main assets that open a world of opportunities in the financial services space -

Lage user base

Data

Scale, logistics and customer support.

In this paper we list some of the key opportunities and companies for partnership. We also describe one disruptive idea that can get rapid traction for the telco in financial services for millennials.

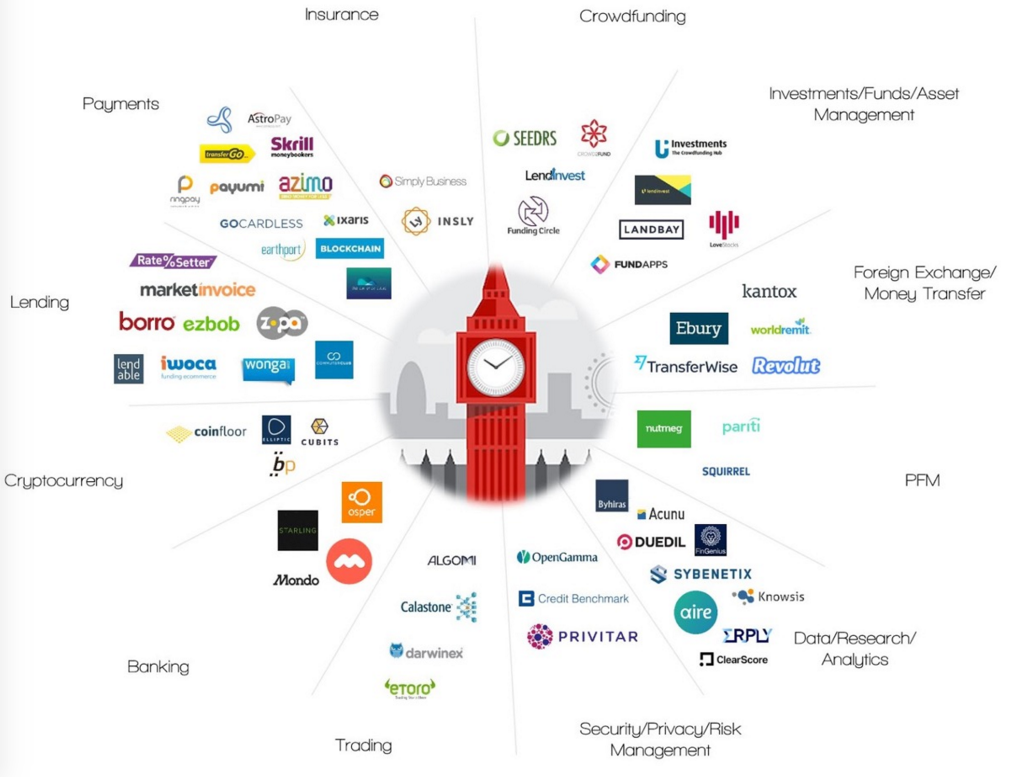

ECOSYSTEM

Fintech Areas

Leading Fintech Companies

Source: Business Insider

Opportunities

After analyzing nearly 250 of the leading fintech companies across different sectors of the financial services industry, we think there are three opportunities that should be targeted.

A telco with its large user base and even larger data pool can be a valuable partner to any popular fintech company.

Fintech companies are in a growth phase and will perceive a large telco as a perfect partner in learning about logistics and scale

Modern Banking for millennials

Digital banking companies bring modern features to suit the mobile first lifesyles of millennials. Traditional banks don't have the same appeal among the millennials with their poor and dated user interfaces and features.

While they score high points in design and product features, they still have teething issues in scale. These new banking companies can use the supply chain, customer support and logistics networks of a large telco to scale rapidly.

Flexibility for a Global Lifestyle

Telcos contain valuable data on travel patterns of users and this can be used to enhance travel, currency exchange, currency transfer and other features that can be very appealing to users who lead a global lifestyle.

Access to credit to previously underserved demographics

Millennials, immigrants, minorities and several other demographics can get access to banking and credit even with low or no credit history since data can be verified by fintech apps on their salaries and payment potential.

The telco can augment the data used to assess the viability of a user by these digital banking apps with its trove of data, in a careful manner with appropriate permission from the users.

Key Startups

Starling Bank

Monese

Revolut

These startups provide most of the features discussed above in the UK. These startups are also well funded and have proven their viability and rapid growth in the market.

A Disruptive Opportunity

Instant Credit for Millennials

Affirm, a San Francisco startup from PayPal co-founder Max Levchin, is going after millennials with a new kind of credit card alternative that only exists online.

People can sign up through the website or at checkout on some web stores for financing from Affirm that’s paid off in monthly installments.

Partnership with Affirm

Millennials can plan their travel, buy fashion items, furniture etc. from popular UK brands and pay with financing from a joint venture between Affirm and the UK telco.

This instant credit can only be available (at least for a negotiated period of time) to users who are subscribers of the telco.

Bring UK brands to the table

The UK telco can bring UK brands popular with millennials to the deal, ensuring the credit technology works on the websites and apps of these brands.

Affirm does not have access to these brands and this can be a strong value proposition from the telco.

This can also significantly enhance the brand value of the telco among millennials with association with the popular brands.

Attract new users to the telco

As this credit venture grows in popularity, this can attract a new customer base to the telco.

The telco can provide referral links, further credit incentives and use other viral techniques to help its existing user base who use the credit feature to attract their friends to become new customers of the telco.

Summary